Top 10 Tax Things to Know

We all want to put 2020 behind us, but there is one lingering task left to complete: filing your taxes.

The most important tax day of the year is around the corner so do not wait much longer.

Below we highlight some key things to consider for the 2021 tax filing season.

1.Tax Filing Deadline Date: Monday, April 18th, 2022. Link for additional information:

2. Extension: Extends the Tax Filing Deadline Date: Monday, October 17th, 2022. If you are interested in an extension, please let me know.

Here is what you need to know about filing an extensions:

1) An extension of time to file your return does not grant you any extension of time to pay your taxes.

2) You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties.

3) You must file your extension request no later than Monday, April 18th, 2022

4) You can file an extension through this website link or ask us for assistance.

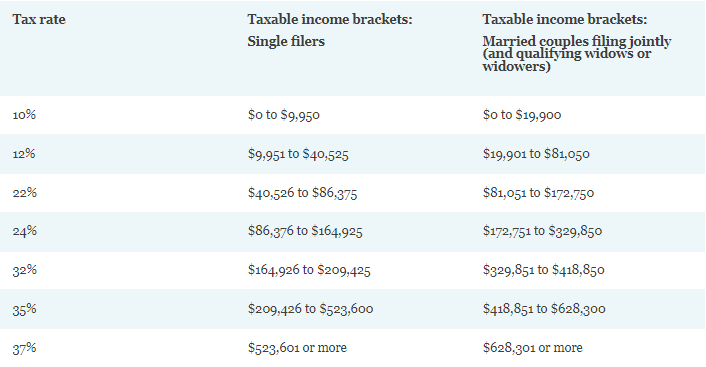

3. The Income Tax Brackets and Rates for 2021 have shifted a little bit as compared to 2020:

Source: Internal Revenue Services

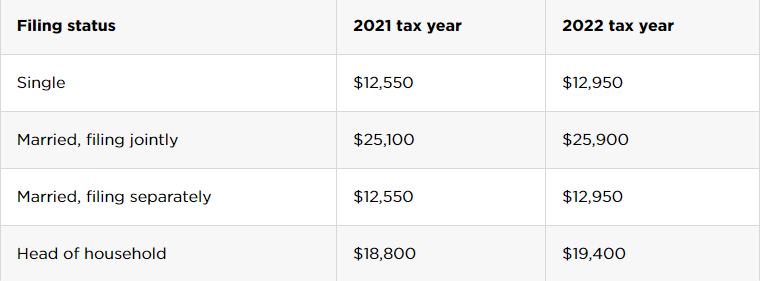

4. The 2021 Standard Deduction increased however Itemized Deductions remain the same:

When you pay taxes, you have the option of taking the standard deduction or itemizing your deductions. If you itemize, you calculate your deductions one by one. Itemizing is more of a hassle, but it’s worth it if your itemized deductions exceed the amount of the standard deduction. Below is the standard deduction for 2021 and 2022:

5. Retirement Accounts: The IRS made no changes employee contribution limit for 401(k), 403(b) and most 457 plans to $19,500 for 2021. If you’re 50 or older, you can contribute another $6,500 in that workplace retirement plan; amounts are consistent with 2020.

The contribution limit for individual retirement accounts, whether traditional or Roth, is holding steady at $6,000, plus another $1,000 for individuals 50 and over.

6. Health Savings Account: If you choose a high-deductible plan during open enrollment season, you might have access to a health savings account.

These accounts allow you to put away pre-tax or tax-deductible money and have it grow free of taxes. You can take a tax-free withdrawal to cover qualified health expenses.

In 2021, you can save up to $3,600 if you’re an individual with self-only health coverage. That’s up from $3,550 in 2020. Account-holders with family plans can save up to $7,200 in this account (up from $7,100 in 2020).

7. The Child Tax Credit has been expanded.

For 2021, the American Rescue Plan Act (ARPA) has temporarily modified the Child Tax Credit requirements and amounts for household incomes below $75,000 for single filers and $150,000 for married filing jointly.

First, the ARPA has raised the age limit for dependents from 16 to 17. In addition, the child tax credit has increased from $2,000 to $3,000 for children age 6 through 17 and up to $3,600 for children under 6. If your income exceeded the above limits but was below $200,000 for single filers or $400,000 for joint filers, you’ll receive the standard child tax credit of $2,000 per child.

The IRS began sending monthly advance Child Tax Credit payments to eligible families in July and sent its last advance in December. If your dependent didn’t qualify for the child tax credit, you may still qualify for up to $500 of tax credits under the “credit for other dependents” (see IRS Publication 972 for more details). Tax credits, which reduce the tax you owe dollar for dollar, are generally better than deductions, which reduce your taxable income.

8. Estate and Gift Tax: For 2021, the lifetime gift and estate tax exemption will be $11.7 million per individual, up from $11.58 million in 2020.

Finally, the annual gift exclusion — the amount you can give to any other person without it counting against your lifetime exemption — will hold steady at $15,000 for 2021.

9. Charitable Gift Deductions: More donations to charity can be deducted for 2020 under the CARES Act.

The 60%-of-AGI limit on deductions for cash donations by people who itemize is suspended (gifts to donor-advised funds and private non-operating foundations are excluded). The relief applies only to charitable cash contributions that you make this year and deduct on the Schedule A that you file in 2021. Carryovers of excess charitable contributions from prior years don't get the break.

Nonitemizers can also write off up to $300 of charitable cash contributions. This is a new "above-the-line" deduction for 2020 only. It also applies only for people who don't file Schedule A. This write-off is per return, meaning married couples who file jointly can only deduct $300, not $600.